December 2025 Housing Market

Jan. 02, 2026 | CREB 2025 housing market shifted to more balanced conditions Calgary, Alberta, Jan. 2, 2026– Following several years ...

READ POSTBlogging has not been my strength and so this is officially a work in progress. I have some big plans for the blogging page in the foreseeable future so I ask for your patience as I venture into this side.

Market Updates, January 7 2026 I am pleased to present the Sotheby’s International Realty® brand’s 2026 ...

Times Are Tough, But Finding Low-Cost Fun Shouldn't Be Here Are Things To Do This Month FOR FREE Legacy’s ...

Jan. 02, 2026 | CREB 2025 housing market shifted to more balanced conditions Calgary, Alberta, Jan. 2, 2026– Following several years ...

READ POSTCREB® REALTORS® award $100,000 to seven non-profit organizations to ensure vulnerable Calgarians have safe, secure housing Calgary, ...

READ POSTConditions remain relatively balanced as we head into the winter months Calgary, Alberta, Dec. 1, 2025 – In line with typical seasonal ...

READ POSTNov. 03, 2025 | CREB Pace of new listings growth slows, preventing further inventory gains Calgary, Alberta, Nov. 3, 2025– Inventory ...

READ POST

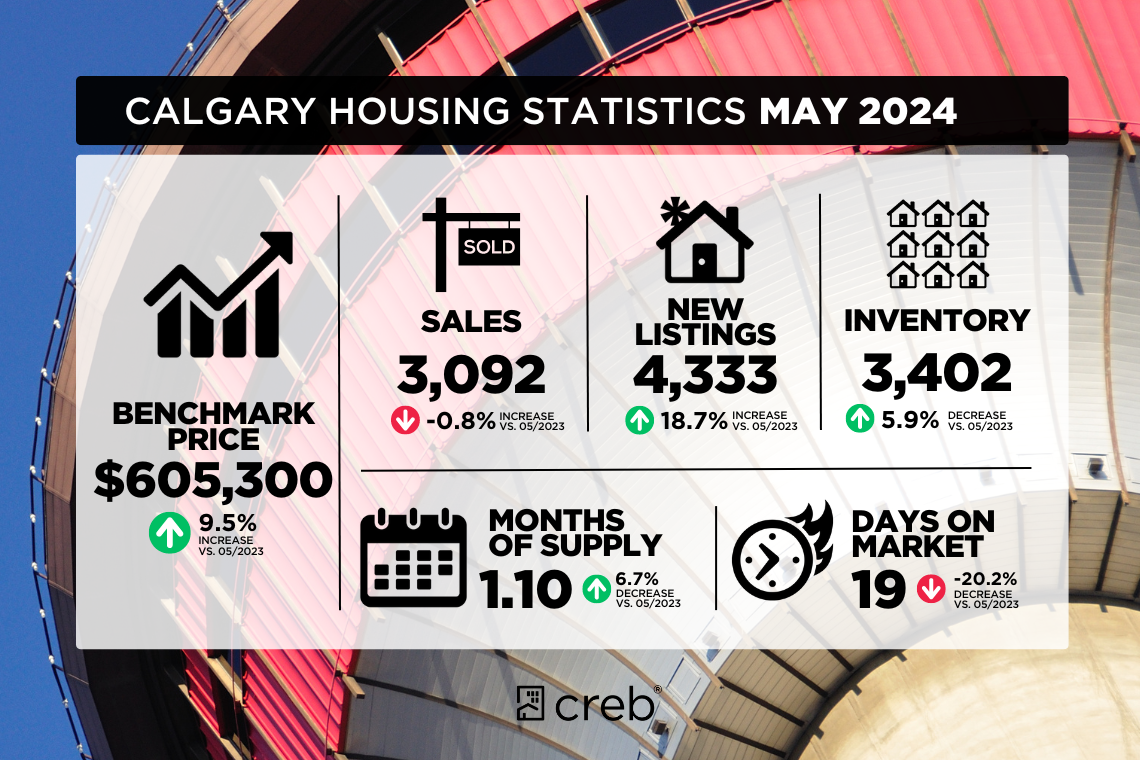

CREB® releases Q2 2024 Calgary and region housing market report

The Calgary Real Estate Board (CREB®) has released its Q2 2024 housing market report, providing an overview of the real estate landscape in Calgary and surrounding areas. The report showcases trends in sales and pricing, offering valuable insights for industry professionals and prospective homebuyers and sellers.

The latest data reveals that new listings have risen for the fourth consecutive quarter compared to the previous year. Much of the gains have occurred in the upper price ranges of each property type, as rising prices and persistently high lending rates are encouraging more sellers to list their properties. The increase in new listings compared to sales caused the sales-to-new listings ratio to fall below 80 per cent for the first time since Q1 2023. While this shift has supported some inventory gains, it is important to note that the market continues to favour sellers with a Q2 sales-to-new-listings ratio of 75 per cent and a months-of-supply of one month.

In the second quarter, sales slowed by three per cent compared to the same period last year. The decline was driven by lower-priced properties, where supply levels are the lowest. Despite this slowdown, sales levels remained 29 per cent above long-term trends. After the first half of the year, sales were nearly six per cent higher than last year's levels.

“The unexpected surge in migration over the past two years has contributed to the demand growth and supply challenges experienced in the Calgary market,” said Ann-Marie Lurie, Chief Economist at CREB®. “While we still have to work through the pent-up demand, slowing migration levels and supply gains in the resale and new home markets should start to support more balanced conditions, taking some of the pressure off home prices.”

So far this year, home prices have risen by 10 per cent, with the most significant gain occurring in row properties at 19 per cent and the lowest growth of 13 per cent in detached and semi-detached homes. Moving forward, increased supply generated through the new home sector will help support a better-supplied rental and ownership market, reducing pressure on home prices. Slowing price growth is anticipated throughout the second half of the year as supply levels improve. However, conditions will vary based on property type and price range. Much of the supply growth is expected to impact higher-priced properties, slowing their growth. Meanwhile, persistently tight conditions for the most affordable properties will continue to drive further price increases.

For the full report, please download CREB®’s Q2 2024 Calgary & Region Quarterly Update Report here.

June sales decline amid supply challenges and rising prices

Sales in June reached 2,738, marking a 13 per cent decline from last year’s record high. Although sales improved for homes priced above $700,000, it was not enough to offset the declines reported in the lower price ranges. Despite the easing in June sales, they remain over 17 per cent higher than long-term trends.

“The pullback in sales reflects supply challenges in the lower price ranges, ultimately limiting sales activity,” said Ann-Marie Lurie, Chief Economist at CREB®. “Inventory in the lower price ranges of each property type continue to fall, providing limited choices for potential purchasers looking for more affordable product. It also continues to be a competitive market for some buyers with over 40 per cent of the homes sold selling over list price.”

This month, new listings also eased relative to sales, causing the sales-to-new-listings ratio to remain elevated at 72 per cent. Inventory levels did improve over last year’s low levels, primarily due to gains in the higher price ranges. However, with 3,789 units available, levels remain 40 per cent lower than long-term trends.

The modest change in inventory levels helped increase the months of supply. However, at 1.4 months, conditions continue to favor sellers. Persistently tight conditions drove further price gains this month. In June, the unadjusted benchmark price rose to $608,000, a gain over last month and nearly nine per cent higher than last year. Prices rose across all districts, with the most significant year-over-year gains occurring in the North East and East districts.

Gains in higher-priced detached home sales were not enough to offset the pullbacks for homes priced below $700,000, leading to a 16 per cent year-over-year sales drop. Despite the recent pullback, detached home sales for the first half of the year remain in line with levels reported last year. Meanwhile, following several months of gains, new listings eased this month. By the end of June, there were 1,775 detached homes in inventory, an improvement over last year but 45 per cent below long-term trends for the month.

While conditions remain tight in the detached market, we are starting to see better supply and demand balances in the upper end of the market. The months of supply have ranged from a low of one month in the most affordable East district to just over two months in the City Centre. Nonetheless, with less than one and a half months of supply, we continue to see upward pressure on home prices. In June, the unadjusted benchmark price reached $767,600, nearly one per cent higher than last month and 12 per cent higher than prices reported last June.

Following a significant gain last month, new listings pulled back in June relative to sales, causing the sales-to-new-listings ratio to rise to 76 per cent. While this did not prevent some gains in inventory levels, inventory levels remained nearly half of those traditionally seen in June.

With just over one month of supply, we continue to see upward pressure on home prices. In June, the unadjusted benchmark price reached $686,100, a one per cent gain over last month and over 12 per cent higher than levels reported last year. Prices rose across all districts in the city, with the steepest gains occurring in the most affordable areas of the North East and East districts.

Like other property types, row home sales slowed in June relative to the high levels achieved over the past two years. A higher pullback in sales compared to new listings caused the sales-to-new-listings ratio to fall to 75 per cent, the lowest June level reported since 2021.

However, conditions remain exceptionally tight with one month of supply, especially for properties priced below $600,000. The unadjusted benchmark price trended up in June, reaching $464,600, nearly 17 per cent higher than levels reported last year at this time. While price adjustments have varied depending on location, we continue to see the highest price growth occurring in the most affordable districts.

There were 791 sales in June, a nearly eight per cent decline over last year. The decline in sales was primarily due to the significant pullback for units priced below $300,000. Limited supply choice for lower priced products is preventing stronger sales activity. Despite the monthly pullback, year-to-date apartment sales are up by 13 per cent, and are at record-high levels.

New listings continue to rise relative to sales, causing the sales-to-new-listings ratio to fall and driving further inventory gains. However, much of the supply growth has occurred for higher-priced properties, resulting in tight conditions at the lower end of the market and more balanced conditions for higher-priced units. Overall prices continued to trend up this month, reaching $344,700, over 17 per cent higher than last year.

REGIONAL MARKET FACTS

June sales remained relatively stable compared to last year at levels that remain well above long-term averages. At the same time, we saw a boost in new listings this month compared to last year. However, with 269 new listings and 209 sales, the sales-to-new-listings ratio remained elevated at 78 per cent, keeping inventories relatively low based on historical standards.

Like Calgary, Airdrie is experiencing the tightest conditions for the most affordable sectors of the market, and prices continue to rise. In June, the unadjusted benchmark price rose to $554,500, nearly one per cent higher than last month and nine per cent higher than last year’s levels. Price growth has been the highest for apartment-style properties.

June sales improved over last year’s levels, contributing to the year-to-date gain of seven per cent. This was possible thanks to the boost in new listings in June. However, the gains in new listings did little to impact the inventory levels, which remained consistent with levels reported last year and are 44 per cent lower than levels we typically see in June.

With nearly one and a half months of supply, conditions continue to favour the seller, driving further price gains this month. In June, the unadjusted benchmark price was $571,100, an increase over last month and nearly nine per cent higher than last year’s levels. Like Airdrie, the price growth was strongest for apartment-style units, which are also the most affordable products available in the town.

Sales in June slowed compared to last year, mostly due to a pullback in the detached sector. Sales activity has been somewhat restricted due to the limited supply options. As of June, there were 81 units in inventory, 56 per cent lower than levels we typically see in the month, and detached supply is nearly 63 per cent lower.

Persistently tight market conditions have kept prices elevated compared to last year. While there has been some monthly fluctuation, year-to-date prices are nearly nine per cent higher than last year’s levels.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Market Updates, January 7 2026 I am pleased to present the Sotheby’s International Realty® brand’s 2026 ...

Jan. 02, 2026 | CREB 2025 housing market shifted to more balanced conditions Calgary, Alberta, Jan. 2, ...