December 2025 Housing Market

Jan. 02, 2026 | CREB 2025 housing market shifted to more balanced conditions Calgary, Alberta, Jan. 2, 2026– Following several years ...

READ POSTBlogging has not been my strength and so this is officially a work in progress. I have some big plans for the blogging page in the foreseeable future so I ask for your patience as I venture into this side.

Market Updates, January 7 2026 I am pleased to present the Sotheby’s International Realty® brand’s 2026 ...

Times Are Tough, But Finding Low-Cost Fun Shouldn't Be Here Are Things To Do This Month FOR FREE Legacy’s ...

Jan. 02, 2026 | CREB 2025 housing market shifted to more balanced conditions Calgary, Alberta, Jan. 2, 2026– Following several years ...

READ POSTCREB® REALTORS® award $100,000 to seven non-profit organizations to ensure vulnerable Calgarians have safe, secure housing Calgary, ...

READ POSTConditions remain relatively balanced as we head into the winter months Calgary, Alberta, Dec. 1, 2025 – In line with typical seasonal ...

READ POSTNov. 03, 2025 | CREB Pace of new listings growth slows, preventing further inventory gains Calgary, Alberta, Nov. 3, 2025– Inventory ...

READ POSTNew listing growth driven by higher-priced homes

|

|

View the CREB® | New listing growth driven by higher-priced homes

Calgary housing market sees shifts

Housing activity continues to move away from the extreme sellers’ market conditions experienced throughout the spring. Easing sales, combined with gains in supply, pushed the months of supply above two months in August, a level not seen since the end of 2022.

“As expected, rising new home construction and gains in new listings are starting to support a better-supplied housing market,” said Ann-Marie Lurie, Chief Economist at CREB®. “This trend is expected to continue throughout the remainder of the year, but it’s important to note that supply levels remain low, especially for lower-priced properties. It will take time for supply levels to return to those that support more balanced conditions.”

Inventory levels in August reached 4,487 units, 37 per cent higher than last August but nearly 25 per cent lower than long-term trends for the month. Higher-priced properties mostly drove the supply gains, as the most affordable homes in each property type continued to report supply declines.

The supply gains were made possible by both an increase in new listings in August and a pullback in sales activity. There were 2,186 sales in August, representing a 20 per cent decline from last year's record high but still 17 per cent higher than long-term averages for the month. The sales declines were driven by homes priced below $600,000.

Following stronger-than-expected gains earlier in the year, the pace of price growth is starting to slow. In August, the total unadjusted residential benchmark price was $601,800, six per cent higher than last year and just slightly lower than last month. Year-to-date, the average benchmark price rose by nine per cent.

Detached home sales fell by 14 per cent compared to last year, as gains in homes priced above $600,000 were not enough to offset declines in the lower price ranges, which continue to struggle with low supply levels. In August, there were 2,011 detached homes available in inventory, with over 85 per cent priced above $600,000.

The improving higher-end supply compared to sales helped push the months of supply up to nearly two months. While market conditions are still tight, this is a significant improvement from the under-one-month supply experienced in the spring. Shifting conditions are relieving some pressure on home prices. In August, the unadjusted detached benchmark price was $762,600, slightly lower than last month but still over nine per cent higher than last year.

With 297 new listings and 172 sales, the sales-to-new-listings ratio in August dropped to 58 per cent, which is more consistent with pre-pandemic levels. This shift supported a rise in inventory levels, and the months of supply rose to nearly two months.

While conditions remain relatively tight, the boost in new listings has helped ease some of the pressure on prices. In August, the unadjusted benchmark price was $681,200, a decline from last month but nearly 10 per cent higher than last year.

New listings row for homes priced above $400,000, contributing to year-to-date growth of nearly 16 per cent. At the same time, slower sales over the past three months have contributed to inventory gains. In August, there were 660 units available, a 75 per cent increase over the exceptionally low levels reported last year. While inventories are still low by historical standards, as with other property types, this shift is helping ease pressure on home prices.

The unadjusted benchmark price in August was $461,700, slightly lower than last month but over 12 per cent higher than last August. Monthly adjustments were not consistent across districts, with adjustments in the City Centre, North West, North, and West districts mostly driving monthly declines. Despite the monthly adjustments, year-over-year prices remain higher than last year across all districts and range from a low of 10 per cent in the City Centre to a high of 26 per cent in the East district.

New listings in August reached 1,001 units, a record high for the month. The gains in new listings were met with a pullback in sales, causing the sales-to-new-listings ratio to drop to 60 per cent and inventories to rise to 1,476 units. Unlike other property types, overall condominium inventory levels were relatively consistent with longer-term trends for the month.

Rising inventory and easing sales caused the months of supply to increase to nearly two and a half months, not as high as levels seen before the pandemic but an improvement over the extremely tight conditions seen over the past 18 months. In August, the unadjusted benchmark price was $346,500, similar to last month and nearly 16 per cent higher than last year’s prices.

REGIONAL MARKET FACTS

New listings in Airdrie continued to rise this month compared to last year. However, with 242 new listings and 172 sales, the sales-to-new-listings ratio remained relatively high at 71 per cent. This prevented a stronger gain in inventory levels and kept the months of supply below two months. The tightest conditions in the market continue to be in the lower price ranges of each property type.

While conditions continue to favour the seller, they are not as tight as during the spring months, taking some pressure off home prices. In August, the unadjusted benchmark price was $553,300, similar to last month and nearly eight per cent higher than last year.

August reported 81 sales and 109 new listings, keeping the sales-to-new-listings ratio elevated at 74 per cent, enough to prevent any gain in inventory levels. With 144 units available, inventory levels are nearly 42 per cent below long-term trends for the month.

Persistently tight conditions continue to drive further price growth in the town. In August, the unadjusted benchmark price was $578,600, slightly higher than last month and over eight per cent higher than last year’s levels. Prices have risen across all property types, with the largest gains occurring for apartment-style properties.

A boost in detached sales supported the rise in August sales compared to last year. The 67 sales in August were met with 84 new listings, pushing the sales-to-new-listings ratio near 80 per cent. This prevented any significant shift in inventory levels, which remain nearly 47 per cent lower than long-term trends.

With just over one month of supply, conditions remain relatively tight. The unadjusted benchmark price in August was $622,700, similar to last month and over seven per cent higher than last August.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Supply levels improve, taking some pressure off prices

With the busy spring market behind us, we are starting to see some shifts in supply levels. With 2,380 sales and 3,604 new listings, the sales-to-new listings ratio fell to 66 per cent, supporting a gain in inventory. Inventories rose to 4,158 units, still 33 per cent below what we typically see in July, but the first time they have pushed above 4,000 units in nearly two years.

Although the majority of supply growth occurred for homes priced above $600,000, the rise has helped shift the market away from the extreme sellers’ market conditions experienced throughout the spring.

“While we are still dealing with supply challenges, especially for lower-priced homes, more options in both the new home and resale market have helped take some of the upward pressure off home prices this month,” said Ann-Marie Lurie, Chief Economist at CREB®. “This is in line with our expectations for the second half of the year, and should inventories continue to rise, we should start to see more balanced conditions and stability in home prices.”

July sales eased by 10 per cent over last year's record high but were still higher than long-term trends for the month. Like last month, the pullback in sales has been driven by homes priced below $600,000.

Nonetheless, the gain in inventory combined with slower sales caused the months of supply to rise to 1.8 months, still low enough to favour the seller but a significant improvement from the under one month reported earlier this year.

Improved supply helped slow the pace of monthly price growth for each property type. In July, the total residential benchmark price was $606,700, similar to last month and nearly eight per cent higher than last year's levels.

Detached home sales in July fell by eight per cent, as the 15 per cent rise for homes priced above $600,000 was not enough to offset the 50 per cent decline occurring in the lower price ranges.

The decline in the lower price ranges reflects limited availability as inventories and new listings continue to fall for lower-priced homes. Year-to-date detached sales have eased by just over one per cent compared to last year.

With 1,098 sales and 1,721 new listings this month, inventories rose to 1,950 units. Inventories are still low based on historical levels, but the gain did help push the months of supply up to nearly two months and supports some stability in prices. The unadjusted benchmark price in July was $767,800, similar to last month but 11 per cent higher than last July.

Relative affordability continues to attract purchasers to the semi-detached sector. While sales did slow slightly compared to last year, year-to-date sales reached 1,518 units, six per cent higher than last year.

The growth in sales was possible thanks to gains in new listings. However, conditions remain relatively tight, with a 76 per cent sales-to-new listings ratio and months of supply of 1.5 months.

While the pace of monthly price growth has slowed, at an unadjusted benchmark price of $687,900, prices are nearly 12 per cent higher than last year. The highest price growth continues to occur in the city's most affordable North East and East districts.

Gains in row new listings relative to a pullback in sales caused the sales-to-new listings ratio to fall to 73 per cent this month. This supported gains in inventory levels, and the months of supply rose to 1.3 months.

While conditions continue favouring the seller, the shift prevented further monthly price gains this month. Nonetheless, at a benchmark price of $464,200, levels are still nearly 15 per cent higher than last year. Year-over-year price gains have ranged from a low of 13 per cent in the City Centre and North districts to over 20 per cent in the North East and East districts.

Sales in July slowed to 659 units, as a significant drop in sales occurred for properties priced below $300,000. Like the other property types, limited supply choices for the lower-priced units prevented stronger sales activity.

New listings in July were 1,043 units, high enough to cause the sales-to-new listings ratio to fall to 63 per cent. This supported inventory gains and months of supply of over two months. Improved supply relative to sales helped slow the pace of monthly price growth.

However, the unadjusted benchmark price of $346,300 is still 17 per cent higher than levels reported last year at this time.

REGIONAL MARKET FACTS

New listings in July rose to 287 units, the highest level ever reported for July. At the same time, sales slowed to 186 units, supporting some gains in inventory levels. While inventories have improved, the 298 units are still 26 per cent lower than typical levels seen in July.

Inventory gains have occurred across most price ranges in Airdrie but conditions continue to remain relatively tight, especially in the lower price ranges of each property type. Overall, the unadjusted benchmark price in July was $553,900, similar to last month but eight per cent higher than last year's levels.

July sales improved over last year’s levels, contributing to the year-to-date gain of nearly eight per cent. While new listings also improved compared to last year in July, it was not enough to cause any significant shift from the low inventory levels.

With a sales-to-new-listings ratio of 83 per cent and months of supply of 1.5 months, the market remained relatively tight, and prices continued to rise. In July, the unadjusted benchmark price reached $576,600, nearly one per cent higher than last month and nine per cent higher than last year’s levels.

A pullback in sales relative to new listings helped support gains in higher inventory levels in Okotoks. While inventory levels are 25 per cent higher than last year, the 85 units still reflect exceptionally low inventory levels and are half the levels typically seen in July.

With a sales-to-new listings ratio of 78 per cent and months of supply of 1.3 months, conditions continue to favour the seller. While there have been some monthly price fluctuations, the unadjusted benchmark price in July reached $622,200, over six per cent higher than last July.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

CREB® releases Q2 2024 Calgary and region housing market report

The Calgary Real Estate Board (CREB®) has released its Q2 2024 housing market report, providing an overview of the real estate landscape in Calgary and surrounding areas. The report showcases trends in sales and pricing, offering valuable insights for industry professionals and prospective homebuyers and sellers.

The latest data reveals that new listings have risen for the fourth consecutive quarter compared to the previous year. Much of the gains have occurred in the upper price ranges of each property type, as rising prices and persistently high lending rates are encouraging more sellers to list their properties. The increase in new listings compared to sales caused the sales-to-new listings ratio to fall below 80 per cent for the first time since Q1 2023. While this shift has supported some inventory gains, it is important to note that the market continues to favour sellers with a Q2 sales-to-new-listings ratio of 75 per cent and a months-of-supply of one month.

In the second quarter, sales slowed by three per cent compared to the same period last year. The decline was driven by lower-priced properties, where supply levels are the lowest. Despite this slowdown, sales levels remained 29 per cent above long-term trends. After the first half of the year, sales were nearly six per cent higher than last year's levels.

“The unexpected surge in migration over the past two years has contributed to the demand growth and supply challenges experienced in the Calgary market,” said Ann-Marie Lurie, Chief Economist at CREB®. “While we still have to work through the pent-up demand, slowing migration levels and supply gains in the resale and new home markets should start to support more balanced conditions, taking some of the pressure off home prices.”

So far this year, home prices have risen by 10 per cent, with the most significant gain occurring in row properties at 19 per cent and the lowest growth of 13 per cent in detached and semi-detached homes. Moving forward, increased supply generated through the new home sector will help support a better-supplied rental and ownership market, reducing pressure on home prices. Slowing price growth is anticipated throughout the second half of the year as supply levels improve. However, conditions will vary based on property type and price range. Much of the supply growth is expected to impact higher-priced properties, slowing their growth. Meanwhile, persistently tight conditions for the most affordable properties will continue to drive further price increases.

For the full report, please download CREB®’s Q2 2024 Calgary & Region Quarterly Update Report here.

June sales decline amid supply challenges and rising prices

Sales in June reached 2,738, marking a 13 per cent decline from last year’s record high. Although sales improved for homes priced above $700,000, it was not enough to offset the declines reported in the lower price ranges. Despite the easing in June sales, they remain over 17 per cent higher than long-term trends.

“The pullback in sales reflects supply challenges in the lower price ranges, ultimately limiting sales activity,” said Ann-Marie Lurie, Chief Economist at CREB®. “Inventory in the lower price ranges of each property type continue to fall, providing limited choices for potential purchasers looking for more affordable product. It also continues to be a competitive market for some buyers with over 40 per cent of the homes sold selling over list price.”

This month, new listings also eased relative to sales, causing the sales-to-new-listings ratio to remain elevated at 72 per cent. Inventory levels did improve over last year’s low levels, primarily due to gains in the higher price ranges. However, with 3,789 units available, levels remain 40 per cent lower than long-term trends.

The modest change in inventory levels helped increase the months of supply. However, at 1.4 months, conditions continue to favor sellers. Persistently tight conditions drove further price gains this month. In June, the unadjusted benchmark price rose to $608,000, a gain over last month and nearly nine per cent higher than last year. Prices rose across all districts, with the most significant year-over-year gains occurring in the North East and East districts.

Gains in higher-priced detached home sales were not enough to offset the pullbacks for homes priced below $700,000, leading to a 16 per cent year-over-year sales drop. Despite the recent pullback, detached home sales for the first half of the year remain in line with levels reported last year. Meanwhile, following several months of gains, new listings eased this month. By the end of June, there were 1,775 detached homes in inventory, an improvement over last year but 45 per cent below long-term trends for the month.

While conditions remain tight in the detached market, we are starting to see better supply and demand balances in the upper end of the market. The months of supply have ranged from a low of one month in the most affordable East district to just over two months in the City Centre. Nonetheless, with less than one and a half months of supply, we continue to see upward pressure on home prices. In June, the unadjusted benchmark price reached $767,600, nearly one per cent higher than last month and 12 per cent higher than prices reported last June.

Following a significant gain last month, new listings pulled back in June relative to sales, causing the sales-to-new-listings ratio to rise to 76 per cent. While this did not prevent some gains in inventory levels, inventory levels remained nearly half of those traditionally seen in June.

With just over one month of supply, we continue to see upward pressure on home prices. In June, the unadjusted benchmark price reached $686,100, a one per cent gain over last month and over 12 per cent higher than levels reported last year. Prices rose across all districts in the city, with the steepest gains occurring in the most affordable areas of the North East and East districts.

Like other property types, row home sales slowed in June relative to the high levels achieved over the past two years. A higher pullback in sales compared to new listings caused the sales-to-new-listings ratio to fall to 75 per cent, the lowest June level reported since 2021.

However, conditions remain exceptionally tight with one month of supply, especially for properties priced below $600,000. The unadjusted benchmark price trended up in June, reaching $464,600, nearly 17 per cent higher than levels reported last year at this time. While price adjustments have varied depending on location, we continue to see the highest price growth occurring in the most affordable districts.

There were 791 sales in June, a nearly eight per cent decline over last year. The decline in sales was primarily due to the significant pullback for units priced below $300,000. Limited supply choice for lower priced products is preventing stronger sales activity. Despite the monthly pullback, year-to-date apartment sales are up by 13 per cent, and are at record-high levels.

New listings continue to rise relative to sales, causing the sales-to-new-listings ratio to fall and driving further inventory gains. However, much of the supply growth has occurred for higher-priced properties, resulting in tight conditions at the lower end of the market and more balanced conditions for higher-priced units. Overall prices continued to trend up this month, reaching $344,700, over 17 per cent higher than last year.

REGIONAL MARKET FACTS

June sales remained relatively stable compared to last year at levels that remain well above long-term averages. At the same time, we saw a boost in new listings this month compared to last year. However, with 269 new listings and 209 sales, the sales-to-new-listings ratio remained elevated at 78 per cent, keeping inventories relatively low based on historical standards.

Like Calgary, Airdrie is experiencing the tightest conditions for the most affordable sectors of the market, and prices continue to rise. In June, the unadjusted benchmark price rose to $554,500, nearly one per cent higher than last month and nine per cent higher than last year’s levels. Price growth has been the highest for apartment-style properties.

June sales improved over last year’s levels, contributing to the year-to-date gain of seven per cent. This was possible thanks to the boost in new listings in June. However, the gains in new listings did little to impact the inventory levels, which remained consistent with levels reported last year and are 44 per cent lower than levels we typically see in June.

With nearly one and a half months of supply, conditions continue to favour the seller, driving further price gains this month. In June, the unadjusted benchmark price was $571,100, an increase over last month and nearly nine per cent higher than last year’s levels. Like Airdrie, the price growth was strongest for apartment-style units, which are also the most affordable products available in the town.

Sales in June slowed compared to last year, mostly due to a pullback in the detached sector. Sales activity has been somewhat restricted due to the limited supply options. As of June, there were 81 units in inventory, 56 per cent lower than levels we typically see in the month, and detached supply is nearly 63 per cent lower.

Persistently tight market conditions have kept prices elevated compared to last year. While there has been some monthly fluctuation, year-to-date prices are nearly nine per cent higher than last year’s levels.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Calgary home sales remain robust despite supply shortages in lower price ranges

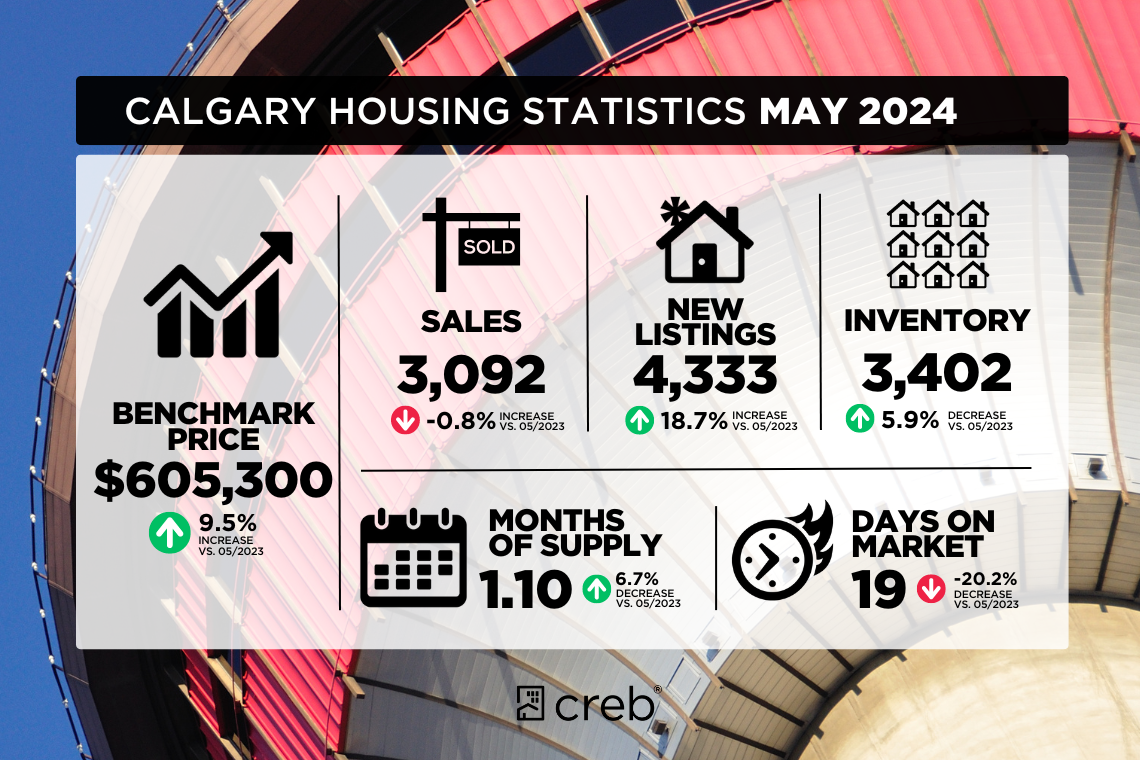

June 3, 2024

Resilient Sales with a Slight Dip | May saw 3,092 resale home sales, which is nearly 1% below last year's record but 34% higher than long-term trends for May. The slight dip in sales is mainly due to fewer lower-priced detached and semi-detached homes available.

Shift Towards Higher-Priced Homes | While new listings increased by almost 19% to 4,333 units, much of this growth was in higher price ranges. This led to a decline in sales of lower-priced homes due to limited supply options.

Modest Inventory Gains and Seller's Market | The increase in new listings relative to sales caused the sales-to-new listings ratio to drop to 71%, leading to a slight year-over-year inventory gain. However, overall inventory levels are still about half of what is typical for May, and the market continues to favor sellers with just one month of supply.

Price Growth Across the City | Seller market conditions have driven price growth across all city districts. The unadjusted total residential benchmark price in May reached $605,300, which is nearly 1% higher than last month and 10% higher than May of the previous year.

Housing Market Facts

Detached | The gain in detached sales for homes priced over $700,000 was not enough to offset pullbacks across the lower price ranges, as year-over-year sales declined by seven per cent. At the same time, new listings rose enough to cause the sales-to-new-listings ratio to drop to 68 per cent, supporting inventory growth. However, inventory levels for homes priced below $600,000 continued to fall, accounting for only 13 per cent of the detached market.

With just over one month of supply, the detached market continues to favour the seller, and prices continue to rise. As of May, the unadjusted benchmark price reached $761,800, over one per cent higher than last month and 13 per cent higher than prices reported last year. Prices improved across all districts, with the most significant year-over-year gains occurring in the most affordable districts.

Semi-Detached | The year-over-year decline in sales did not offset earlier gains, as year-to-date sales rose by nearly 11 per cent. Like the detached sector, we have also seen improved levels of new listings come onto the market, causing the sales-to-new listings ratio to drop to 72 per cent and driving some gains in inventory levels.

Nonetheless, the market continues to favour the seller with one month of supply. The persistently tight market conditions continue to drive up prices. The benchmark price reached $678,000 in May, over one per cent higher than last month and 13 per cent higher than last May.

Price growth persists in Calgary as seller's market prevails

May 1, 2024

Sales Growth and Market Trends | Despite a slight easing in the pace of growth compared to earlier in the year, sales in April increased by seven per cent compared to last year. This growth is significant as it remains 37 per cent higher than long-term trends for the month. The data also indicates that much of the growth in sales is focused on relatively more affordable, higher-density products.

New Listings and Inventory Dynamics | April saw an 11 per cent gain in new listings compared to last year, but this increase was only three per cent higher than long-term trends. The rise in new listings helped prevent further deterioration of the inventory situation, but inventory levels are still 16 per cent below last year and significantly lower than traditional levels for April. Notably, the decline in supply has been driven by lower-priced homes, while there's been supply growth in higher-priced properties.

Market Conditions and Seller Advantage | With a sales-to-new-listings ratio of 83 per cent and a months of supply of less than one month, market conditions strongly favour sellers. This indicates high demand relative to supply, which is driving further price gains in the market.

Price Trends and Affordability Impact | The unadjusted total residential benchmark price reached $603,700 in April, marking a one per cent gain over the previous month and nearly a 10 per cent increase compared to last year. Price gains were observed across all property types and districts, with the most robust growth occurring in the more affordable districts of the city. This suggests that persistently high-interest rates are influencing demand toward more affordable products in the market, while listing growth is focused on higher-priced properties.

Housing Market Facts

Detached | Detached home sales rose by one per cent in April compared to last year. Sales gains in the higher price ranges offset the steep decline for homes priced below $600,000, which is related to the lack of listings in the lower price ranges. While detached new listings did report a year-over-year gain of 10 per cent, detached homes priced below $600,000 saw new listings decline by 34 per cent.

Adjustments in sales and inventory levels caused the months of supply to fall further this month. The less than one-month supply reflects a market favouring the seller, driving further price growth. In April, the unadjusted benchmark price reached $749,000, over one per cent higher than last month and 13 per cent higher than April 2023 levels. Year-over-year gains were the highest in the city's most affordable districts.

Semi-Detached | Sales activity continued to rise in April, contributing to the nearly 18 per cent year-to-date growth in sales. The growth in sales was partly due to gains in new listings. However, the growth in new listings did little to change the low inventory situation, as the months of supply remained below one month for the second month in a row.

The persistently tight market conditions have caused further price gains. In April, the unadjusted benchmark price reached $668,400, nearly two per cent higher than last month and 13 per cent higher than levels reported last year. Year-over-year price gains ranged from a high of 23 per cent in the East district to a low of 10 per cent in the City Centre.

Canada’s luxury real estate market eased into spring with modest sales gains across key metropolitan cities, as the dynamic between prospective home sellers and buyers improved, and pricing expectations continued to come into alignment. Despite strengthening consumer confidence and an increase in early-stage market engagement in the initial months of 2024, the expectation of additional property listings supply and potential interest rate declines prompted some buyers and sellers to defer transactions into the spring market. As a result, the country’s major metropolitan areas are expected to see a moderate improvement in sales activity across the luxury and conventional markets in the months ahead.

“Over the past two years, as conventional and luxury real estate market conditions softened under the influence of climbing interest rates and changes to taxes and regulations relating to home ownership, persistent tension defined the interactions between home sellers holding onto lofty pricing expectations from previous peaks, and buyers seeking properties priced for the current market. This stand-off slowed transactional momentum in several of Canada’s major metropolitan luxury real estate markets in 2023, particularly in Vancouver and Toronto, where hyper-inflation of luxury housing prices was the previous norm,” says Don Kottick, President and CEO of Sotheby’s International Realty Canada. “Luxury market dynamics at the start of 2024 reflect a progressive shift in consumer psychology: sellers are now engaging in the market with more realistic pricing strategies, and in some cases, greater motivation to sell. This is setting the stage for productive negotiations with buyers and investors. We expect to see higher transactional volumes and improved market fluidity throughout the spring market.”

According to Kottick, Alberta’s luxury real estate market has continued to defy national trends and outperform other major metropolitan areas as its major cities, Calgary and Edmonton, continue to attract new residents motivated by favourable costs of living, comparatively affordable top-tier home prices and a dynamic business climate.

Toronto

According to Sotheby’s International Realty Canada’s Top-Tier Real Estate: Spring 2024 State of Luxury Report, consumer dynamics in the Greater Toronto Area (GTA) evolved in the first quarter of 2024, setting the stage for measured sales gains and a balanced market this spring. As the price expectations of home sellers and prospective buyers came into better alignment, both pre-transactional and sales activity increased across the region’s luxury market. As a result, residential real estate sales over $4 million (condominiums, attached and single family homes) between January 1–March 31 climbed 18% year-over-year from the first quarter of 2023. In these preliminary months of the year, there were no property sales over $10 million recorded on Multiple Listings Service (MLS), in contrast to the single property sold in the same period of 2024. Overall GTA residential sales over $1 million rose 11% year-over-year.

Vancouver

Vancouver’s luxury residential real estate market experienced a notable increase in pre-transactional activity in the first quarter of 2024, as consumer and real estate industry confidence continued to strengthen within a market that remained in balance. However, a significant cohort of prospective purchasers continued to await a wider selection of property listings inventory in the spring market to follow. As a result, residential sales over $4 million were down 17% year-over-year in the first quarter of 2024, with none of these recorded over $10 million on MLS compared to four transactions in the first quarter of 2023. Overall, $1 million-plus residential sales were largely on par with previous year’s levels, with a marginal 1% year-over-year shortfall.

Montréal

Luxury sales activity in Montreal reflected a stronger-than-anticipated start to 2024, as residential sales over $1 million between January 1–March 31 increased 53% year-over-year within a market that maintained balanced conditions overall. Residential real estate sales over $4 million were on par with first-quarter 2023 levels at eight units sold.

Calgary

Record in-migration, a bold economy and soaring end-consumer and investor confidence in housing continued to strengthen Calgary’s luxury real estate market performance in the first quarter of 2024. Between January 1–March 31, residential sales over $1 million surged 63% year-over-year, positioning the city as one of Canada’s most dynamic and top-performing luxury markets. $4 million-plus sales were also up year-over-year in the first quarter to two properties sold, in contrast to the quiet market experienced in the first quarter of 2023.

*Disclaimer

The information contained in this report references market data from MLS boards across Canada. Sotheby’s International Realty Canada cautions that MLS market data can be useful in establishing trends over time but does not indicate actual prices in widely divergent neighbourhoods or account for price differentials within local markets. This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information and analysis presented in this report, no responsibility or liability whatsoever can be accepted by Sotheby’s International Realty Canada or Sotheby’s International Realty Affiliates for any loss or damage resulting from any use of, reliance on, or reference to the contents of this document

City of Calgary, April 1, 2024 – March sales rose to 2,664 units, a 10 per cent year-over-year gain and much higher than long-term trends. While new listings did pick up over last month, the 3,172 units were still below what we typically see in March and not enough relative to sales to drive any change in the supply situation. In March, the sales-to-new listings ratio rose to 84 per cent, and the months of supply fell below one month.

“We have not seen March conditions this tight since 2006, which is also the last time we reported high levels of interprovincial migration and a months-of-supply below one month," said Ann-Marie Lurie, Chief Economist at CREB®. “Moreover, we are entering the third consecutive year of a market favouring the seller as the two-year spike in migration has driven up demand and contributed to the drop in re-sale and rental supply. Given supply adjustments take time, it is not a surprise that we continue to see upward pressure on home prices.”

Inventory levels have declined across properties priced below $1,000,000, with the steepest declines occurring for homes priced below $500,000. In March, there were 2,532 units in inventory, 22 per cent lower than last year and half the levels we traditionally see in March.

In March, the unadjusted total residential benchmark price rose to $597,600, a two per cent gain over last month and nearly 11 per cent higher than last year. Prices have increased across all property types, with the most significant year-over-year gains occurring for the relatively more affordable row and apartment-style homes.

Detached home sales rose in March but were likely limited by the level of new listings coming onto the market. New listings in March were 1,386 units, compared to the 1,151 sales, causing the sales-to-new listings ratio to rise to 83 per cent. Inventories also remained relatively stable compared to last month but were 24 per cent lower than last year’s levels and nearly 60 per cent lower than long-term trends for March. Inventory levels dropped across all price ranges, but the most significant fall was in the lower price point. Overall, 71 per cent of the available inventory in March was priced above $700,000.

Low inventories compared to sales caused the months of supply to drop below one month, driving further price gains. The unadjusted detached benchmark price rose to $739,700, a monthly gain of nearly three per cent and a year-over-year gain of 14 per cent. The largest year-over-year gains occurred in the most affordable North East and East districts.

Semi-Detached

Supply availability continues to weigh on the semi-detached sector of the market. In March, 260 new listings were met with 250 sales, causing the sale-to-new listings ratio to rise to 96 per cent. This prevented inventories from improving, and the months of supply dropped below one month. Inventory declines have been driven mainly by properties priced below $600,000.

Limited supply and growing demand drove further price gains in March. The unadjusted benchmark price reached $658,000, nearly three per cent higher than last month and a 14 per cent gain over last March. Prices rose across all districts in the city, with year-over-year gains ranging from a low of 11 per cent in the highest-priced area of the City Centre to 25 per cent in the lowest-priced market in the East district.

Both sales and new listings rose in March. However, with 536 new listings and 449 sales, the sales-to-new listings ratio rose to 84 per cent, preventing any significant monthly change in inventory levels. With 355 units available, inventory levels were 12 per cent below last year’s and 53 per cent below long-term trends for March. The decline in inventory levels was driven by properties priced below $400,000, as inventory levels rose 35 per cent for units priced above $400,000.

The unadjusted benchmark price trended up in March, reaching $448,700, a monthly gain of nearly three per cent and over 20 per cent higher than levels reported at this time last year. The higher-priced City Centre reported the slowest growth in benchmark prices, with the highest growth reported in the city's most affordable districts.

Sales in March reached 814 units, contributing to the first quarter’s record-high sales of 1,940 units, nearly 31 per cent higher than last year. New listings also improved throughout the first three months of the year, but with a March sales-to-new-listings ratio of 82 per cent and a months-of-supply of one month, conditions favoured apartment condominium sellers.

Demand for lower-priced homes has supported the growth of apartment-style properties, but the tight conditions have also contributed to further price gains. In March, the benchmark prices reached $337,700, over two per cent higher than last month and 17 per cent higher than levels reported last March.

REGIONAL MARKET FACTS

Airdrie

March reported 203 sales and 218 new listings. While both new listings and sales improved, with a sales-to-new listings ratio of 93 per cent, inventory levels were 22 per cent below last year and 56 per cent below typical March levels.

With less than one month of supply, it is not surprising that we continue to see upward pressure on home prices. In March, the benchmark price reached $540,400, a monthly gain of two per cent and a year-over-year increase of over nine per cent. Prices improved across all property types, with stronger year-over-year gains for the relatively lower-priced row and apartment-style products.

Following a slower start to the year, sales in March rose to nearly the same level of new listings coming onto the market, pushing the sales-to-new listings ratio up to 99 per cent. This also contributed to further declines in inventory levels, and the months of supply dropped to just over one month.

As of March, the total residential benchmark price reached $555,300, a monthly gain of over one per cent and a year-over-year increase of nearly 12 per cent. Prices rose across all property types, and detached prices pushed above $650,000 for the first time.

Okotoks continues to struggle with supply as the 71 new listings that came on the market this month were met with 65 sales, preventing any improvement in inventory levels. There were only 54 units available in March, a year-over-year decline of 10 per cent and nearly 70 per cent below long-term trends for the month.

Limited supply and strong sales caused the months of supply to fall below one month, and March was the lowest March reported since 2006. Persistently tight conditions drove further price growth this month, as the total residential benchmark price rose to $610,700, a monthly gain of one per cent and a year-over-year increase of nine per cent. Prices have been rising for all property types, with the most significant year-over-year gains occurring for semi-detached and row properties.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package

Market Updates, January 7 2026 I am pleased to present the Sotheby’s International Realty® brand’s 2026 ...

Jan. 02, 2026 | CREB 2025 housing market shifted to more balanced conditions Calgary, Alberta, Jan. 2, ...